The image below is a very simple depiction of the markets by none other than Carl Richards. We as investors are equipped or armed with the most powerful weapon of them all – Time. You may have heard the phrases “Time in the market not timing the market”. Take some time to read our financial planning and investment offerings, here.

If you are looking for the next big thing, passive investments probably aren’t your boat and your best off turning your attention to Cheltenham Races in a months’ time. Instead, if you are willing to apply the “Invest and Forget” tactics and sit tight and have trust in your financial adviser when things get ropey in the investment markets, you will be a long time winner.

Investing is relatively simple if you really think about it. As someone who deals with it 52 weeks a year… On the contrary, Investments and Financial Planning in general is layered with jargon and is in fact anything but simple for the majority of the public.

Long term investment

You may have heard the term ‘the trend is your friend’. It holds true when we talk about the market as a whole. The long term trend with the stock market is up which is why most people rich or poor who want to increase their wealth look towards stocks as one of the favoured methods to do that.

The problem with this trend is that people don’t realize that the market means the entire basket of stocks and the long run means a very long period of time. There has never been a 15 year period where stocks lost money.

While that might not sound particularly enticing to a novice investor – it’s quite likely that you’d need some real bad luck to be stuck within that long a period without a positive return.

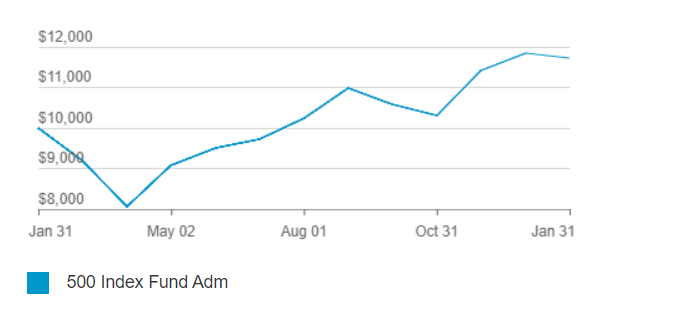

Throughout 2020 and into 2021, we have been challenged like never before in every aspect of our lives. This of course, applies to investments and no doubt people have been challenged to sit tight when all around them were at panic stations. To give you context, if you had €10,000 investment value at 01/01/2020 invested within the S&P 500 Index, and you moved to cash in April (bottom of the market) as a reaction to the COVID-19 break out, your fund would be worth €8,042. If you sat there until now your fund could quite possibly be even less as charges may erode into the fund value due to the low return on cash.

As you can see on the diagram above, if you had applied the “invest and forget” tactics and had not listened to market noise your €10,000 initial value would now be worth €11,721. This is the ultimate validation for the time in the market over timing the market methodology, as it has transpired to be true in what has arguably been the most turbulent times in a generation.

Investment best practices

To summarize, if you want to give yourself the best chance of success within the investment markets there are 3 key steps.

1. Find yourself a trusted Financial Advisor.

2. Invest in line with your goals and your risk tolerance with confidence in your Financial Advisors advice.

3. Stick to the plan and don’t react to market noise.

To finish, if you have read this and it sparks your attention and you would like to find out more on the topic, I can offer two options!

Firstly you can contact me directly at daniel@sysgroup.ie or visit my profile here. Alternatively you can continue to follow these blogs that will be on the SYS website.